Navigating Florida’s Construction Bonding Requirements: Your Complete Guide to Success with Expert Guidance

Florida’s commercial construction sector represents one of the nation’s most dynamic and opportunity-rich markets, with billions of dollars in projects spanning from Miami’s urban high-rises to Jacksonville’s industrial complexes. However, accessing these lucrative opportunities requires more than just construction expertise and competitive pricing. In today’s market, surety bonds have become the key that unlocks doors to major commercial projects, and understanding how to navigate Florida’s complex bonding landscape can mean the difference between business growth and missed opportunities. Guignard Company has emerged as a leading surety bond for Florida construction specialist, helping contractors throughout the state transform bonding requirements from obstacles into competitive advantages.

Understanding Florida’s Unique Construction Bonding Environment

Florida’s construction bonding requirements reflect the state’s unique combination of rapid growth, diverse project types, and complex regulatory environment. Unlike many states where bonding requirements remain relatively static, Florida’s dynamic market conditions create constantly evolving bonding challenges that require expert navigation and strategic planning.

The state’s geographic diversity creates distinct regional bonding considerations. Coastal construction projects face additional requirements related to hurricane resistance, environmental protection, and specialized building codes. Urban projects in cities like Miami, Tampa, and Orlando must navigate complex municipal requirements and high-density construction challenges. Rural and suburban projects present their own unique considerations related to infrastructure access and local regulatory requirements.

Project diversity further complicates Florida’s bonding landscape. The state’s construction market includes everything from luxury hospitality facilities and theme park attractions to industrial manufacturing plants and healthcare facilities. Each project type carries distinct risk profiles and bonding requirements that must be carefully understood and addressed.

Regulatory complexity adds another layer of consideration to Florida’s bonding environment. State, county, and municipal requirements often overlap and sometimes conflict, creating challenges for contractors seeking to understand their obligations. Environmental regulations, particularly in coastal and environmentally sensitive areas, can significantly impact bonding requirements and risk assessment processes.

The Strategic Importance of Professional Bonding Partnerships

Successful navigation of Florida’s construction bonding landscape requires more than just understanding technical requirements; it demands strategic partnerships with experienced professionals who understand both the bonding process and the construction industry’s unique challenges. Guignard Company’s approach to bonding goes far beyond simple transaction processing to encompass comprehensive strategic support that helps contractors build stronger, more successful businesses.

Professional bonding relationships begin with comprehensive assessment of contractors’ current capabilities, market position, and growth objectives. This assessment process helps identify opportunities for capacity enhancement while addressing potential challenges before they impact bonding availability or terms. Guignard Company’s experienced team brings decades of combined experience in construction, finance, and risk management to this assessment process.

Strategic bonding planning considers not just immediate project requirements, but long-term business development objectives. This planning process helps contractors structure their bonding programs to support sustainable growth while maintaining appropriate risk management standards. The result is often enhanced bonding capacity that enables access to larger, more profitable projects.

Ongoing relationship management ensures that bonding programs remain aligned with contractors’ evolving needs and market conditions. Regular reviews, proactive communication, and strategic adjustments help maintain optimal bonding terms while identifying new opportunities for business development and capacity enhancement.

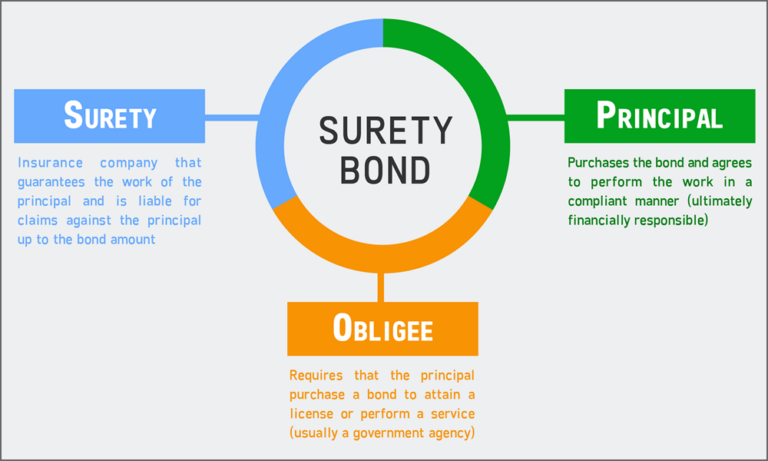

Comprehensive Understanding of Bond Types and Applications

Effective bonding strategy requires thorough understanding of how different bond types serve specific functions within the construction process. Each bond type addresses particular risks and requirements, and successful contractors learn to leverage these tools strategically rather than viewing them simply as necessary expenses.

Bid Bonds serve as the foundation of competitive project pursuit in Florida’s commercial construction market. These bonds guarantee that winning bidders will honor their commitments to enter into contracts at bid prices and provide required performance and payment bonds. Beyond this basic function, bid bonds serve important strategic purposes that can significantly impact contractors’ competitive positions.

The disciplining effect of bid bonds helps ensure serious competition while protecting project owners from frivolous or unrealistic bids. This protection benefits qualified contractors by reducing the likelihood of unrealistic competition that might distort project pricing. Professional contractors who consistently provide bid bonds build reputations for reliability and professionalism that often lead to preferred relationships with project owners.

Capacity demonstration through bid bonds enables contractors to compete for projects that might otherwise be considered beyond their reach. When combined with appropriate performance and payment bond commitments, bid bonds signal to project owners that contractors possess both the financial resources and professional relationships necessary to complete complex projects successfully.

Performance Bonds represent the core protection mechanism for project owners while enabling contractors to demonstrate their commitment to project completion. These bonds guarantee that projects will be completed according to contract specifications, even if original contractors encounter financial or operational difficulties.

The underwriting process for performance bonds often helps contractors identify operational improvements that strengthen their overall business performance. Surety companies evaluate contractors’ project management capabilities, financial management practices, and quality control systems as part of the bonding process. This evaluation often reveals opportunities for improvement that benefit contractors regardless of specific bonding outcomes.

Risk sharing through performance bonds enables contractors to pursue larger, more complex projects than they might otherwise attempt. The surety company’s involvement provides additional oversight and support that can help ensure project success while protecting all parties’ interests.

Payment Bonds create stable supply chains that benefit all project participants while demonstrating contractors’ commitment to fair dealing with subcontractors and suppliers. These bonds guarantee payment for labor and materials provided on bonded projects, eliminating collection risks for supply chain partners.

Supply chain stability created by payment bonds often translates into competitive advantages for bonded contractors. Subcontractors and suppliers prefer working with bonded contractors because payment bonds eliminate collection risks. This preference often results in better pricing, priority scheduling, and access to high-quality partners who might otherwise be unavailable.

Relationship building through payment bonds extends beyond individual projects to create long-term partnerships within the construction community. Contractors who consistently provide payment bonds build reputations as reliable partners, leading to preferred relationships with subcontractors and suppliers that can provide competitive advantages on future projects.

Regional Market Expertise and Local Presence

Guignard Company’s strategic presence throughout Florida reflects the company’s understanding that effective bonding services require deep local market knowledge and responsive regional support. Each of the company’s Florida offices serves distinct market areas with unique characteristics, challenges, and opportunities.

The Orlando office, located at 1904 Boothe Circle Longwood, FL 32750, serves Central Florida’s diverse construction market. This region’s economic base includes tourism, technology, healthcare, and education sectors that generate substantial commercial construction demand. The area’s rapid population growth and infrastructure development create ongoing opportunities for contractors across multiple specialties.

Central Florida’s construction market includes unique project types such as theme park infrastructure, convention facilities, and specialized entertainment venues that require specific bonding expertise. Guignard Company’s local presence enables deep understanding of these specialized requirements while providing responsive support for contractors pursuing these opportunities.

The Tampa office at 1219 Millennium Parkway Suite 113 Brandon, FL 33511, positions Guignard Company at the center of one of Florida’s most dynamic metropolitan construction markets. The Tampa Bay region’s diverse economy generates consistent demand for commercial construction across multiple sectors, from healthcare and education to technology and manufacturing.

Tampa Bay’s construction market benefits from the region’s status as a major transportation hub and its growing reputation as a technology center. These factors create opportunities for contractors specializing in industrial, logistics, and technology infrastructure projects. Guignard Company’s local expertise enables effective support for contractors pursuing these specialized opportunities.

Southwest Florida represents one of the state’s fastest-growing construction markets, driven by population migration, tourism development, and infrastructure expansion. As experienced providers of southwest fl surety bonds for construction, Guignard Company understands the unique requirements and opportunities present in this market.

Coastal construction requirements in Southwest Florida often involve specialized building standards, environmental considerations, and regulatory complexities that affect bonding requirements and risk assessment processes. Guignard Company’s regional expertise enables effective navigation of these requirements while ensuring that contractors receive appropriate bonding support.

Advanced Risk Assessment and Underwriting Capabilities

Effective surety bonding requires sophisticated risk assessment capabilities that go far beyond basic financial analysis. Guignard Company’s underwriting expertise incorporates comprehensive evaluation of contractors’ financial strength, operational capabilities, market position, and growth potential to structure appropriate bonding programs.

Financial analysis forms the foundation of effective risk assessment, but Guignard Company’s approach extends beyond traditional financial statement review to encompass cash flow analysis, working capital management evaluation, and financial projections that provide more complete pictures of contractors’ financial capabilities.

Operational assessment examines contractors’ project management systems, quality control procedures, and safety programs to evaluate their capabilities for successful project completion. This assessment helps identify operational strengths that support larger bonding capacity while revealing areas where improvements might enhance performance and reduce risks.

Market analysis considers contractors’ competitive positions, client relationships, and growth potential within their target markets. This analysis helps structure bonding programs that support business development objectives while maintaining appropriate risk management standards.

Technology Integration and Process Efficiency

Modern surety bonding increasingly relies on technology platforms that streamline processes, improve accuracy, and enhance communication between all parties involved. Guignard Company has invested significantly in technology infrastructure that benefits both operational efficiency and client experience.

Online application and management systems enable contractors to submit bond applications, track processing status, and manage their bonding portfolios through secure, user-friendly interfaces. These systems reduce processing times, minimize paperwork requirements, and provide contractors with real-time visibility into their bonding status.

Digital document management ensures secure, efficient handling of sensitive financial and business information while maintaining comprehensive records that support ongoing relationship management. Contractors benefit from reduced documentation requirements and faster processing times.

Communication platforms enable regular, proactive contact between Guignard Company’s team and clients, helping identify potential issues before they impact bonding relationships while ensuring that contractors receive timely advice on market developments and opportunities.

Carrier Relationships and Market Access

Guignard Company’s relationships with multiple surety carriers provide clients with access to competitive terms and conditions across a broad range of project types and risk profiles. These relationships enable the company to match clients with carriers that best understand their specific industry segments and operational characteristics.

Carrier diversity protects clients from market volatility that might affect individual carriers while providing access to specialized programs designed for specific industry segments or project types. When market conditions change or carriers adjust their underwriting criteria, Guignard Company can often maintain bonding continuity through alternative carrier relationships.

Specialized programs available through carrier relationships often feature more favorable terms, higher capacity limits, or streamlined processing procedures that benefit qualifying contractors. Access to these programs can provide significant competitive advantages for contractors pursuing growth opportunities.

Business Development and Strategic Support

Guignard Company’s commitment to client success extends beyond basic bonding services to encompass comprehensive business development support that helps contractors build stronger, more successful operations. This support reflects the company’s understanding that successful bonding relationships require contractors who continuously improve their capabilities and expand their market presence.

Strategic planning assistance helps contractors develop long-term growth strategies that align with their bonding capabilities and market opportunities. This planning process often identifies opportunities for capacity enhancement while addressing potential challenges before they impact business operations.

Market intelligence provided through Guignard Company’s industry relationships helps contractors identify emerging opportunities, understand competitive dynamics, and position themselves advantageously within their target markets. This intelligence often proves invaluable for strategic planning and business development initiatives.

Networking opportunities through industry connections help contractors build relationships within the construction community that often lead to new business opportunities, subcontracting relationships, and strategic partnerships.

Educational Resources and Professional Development

Staying current with industry best practices, regulatory requirements, and emerging technologies requires ongoing education and professional development. Guignard Company supports client success through various educational initiatives and resources designed to enhance contractors’ capabilities and knowledge.

Training programs and seminars provide opportunities for contractors to learn about bonding processes, risk management strategies, and industry best practices. These programs often feature expert speakers and interactive formats that enable participants to gain practical knowledge applicable to their operations.

Industry publications and resources help contractors stay informed about market developments, regulatory changes, and emerging opportunities. Guignard Company often provides access to specialized publications and research that might otherwise be difficult to obtain.

Professional networking events create opportunities for contractors to connect with industry peers, potential clients, and service providers. These events often prove valuable for business development and knowledge sharing that benefits participants’ long-term success.

Future-Focused Solutions and Market Adaptation

As Florida’s construction industry continues evolving, Guignard Company remains committed to developing innovative solutions that meet emerging market needs. The company’s proactive approach to understanding industry trends and regulatory developments ensures that clients receive appropriate support regardless of how market conditions change.

Emerging construction technologies, including sustainable building practices, prefabrication, and smart building systems, create new opportunities and challenges that require adaptive bonding approaches. Guignard Company’s commitment to staying current with these developments ensures that clients receive appropriate support for innovative projects.

Regulatory evolution, including environmental requirements, safety standards, and local building codes, affects bonding requirements and risk assessment processes. Guignard Company’s ongoing monitoring of regulatory developments helps ensure that clients remain compliant while maintaining competitive bonding terms.

Market expansion opportunities, including geographic growth